Intro

Software or program that helps you automate the processes of your company and speeds up the time in which you carry out your daily tasks is a great tool to increase productivity. If you are currently struggling with the accounting management of your business, accounting software can be very useful.

Accounting software frequently includes capabilities for clearing transaction and payment data as well as creating financial reports. Some even have mobile versions, so you can always add fresh data.

You may believe that your company does not require an automated accounting system since it is still tiny and can be managed using Microsoft Excel, but the sooner you make the changeover, the smoother the procedure will be. Here are some of the reasons why we believe accounting software is superior to Excel.

True, you could tackle the problem by extending the management staff, but you could also use accounting software to make the volume of information more manageable.

5 Benefits of accounting software

- You optimize the management of any business. Accounting software has not been created only to perform calculations or keep a record of the data and transactions of the company, but it allows to analysis the information.

- You save time and money. Having the right software saves time and money. After implementing its use, you can save hours of calculations, searching for information or closing accounts. In addition to spending fewer resources, you avoid possible human errors.

- You facilitate the most complex processes. such as box closings, issuance of invoices, different regularizations, monthly settlements, and so on.

- You decrease the occupation of space. Accounting programs allow you to have all the information, data, and periodic operations for this year and previous years, on your computer’s hard drive or in the cloud. And you also have backup copies.

- You access information in seconds. All you have to do is install the software on your computer or Smartphone so that you can access all the information in seconds, anywhere, and at any time.

01. QuickBooks Online

In this review, we are going to describe the best overall accounting software is QuickBooks Online for small businesses. There are also endless online training resources and forums to get support if needed, that is why the majority of small business accounting professionals use QuickBooks Online. Each one of the accounting functions is accessible from a single dashboard, making bookkeeping more fluid and efficient.

Small companies and their bookkeeping and tax professionals have long relied on QuickBooks Online as their accounting software of choice. The software is hosted in the cloud and can be accessed via a web browser or a mobile app.

Pros

- Cloud-based facility

- Scalable software

- Usually used by accounting professionals

- Integration with third-party applications

- Mobile app

Cons

- Upgrade required for more users

- Random syncing problems with banks and credit cards

QuickBooks Online pricing

Go after the 30-day free trial, the membership tiers are as follows:

Simple Start: $25 per month

Essentials: $40 per month

Plus: $70 per month

Advanced: $150 per month

Typically, a substantial discount is granted for the first few months, and some accountants are even able to offer wholesale prices to small businesses.

This software’s monthly subscription may be updated as a business expands, and the mobile app has several customization choices for receiving payments, reviewing reports, capturing a picture of a receipt, and tracking business travel. QuickBooks Payroll is a payroll system that works seamlessly with QuickBooks Online.

Advanced capabilities like as inventory management, time tracking, extra users, and budgeting are included in each plan. Simple Start will cover all of the demands of most service-based small enterprises. Essentials or Plus will provide greater inventory and customization possibilities for product-based small enterprises. The Advanced subscription is a brand-new product that includes Fathom-powered financial reports. Fathom is a high-end online financial report analysis tool that is utilized by a number of significant corporations throughout the world.

All options allow for third-party app integration, such as Stripe or PayPal. The app shop for QuickBooks Online organizes all of their applications by function and includes useful samples of each product’s benefits.

02. Xero

Xero is the best accounting software for micro-businesses that are seeming for very simple software. The features of this software are a simple user interface and seamless interaction with a third-party payroll provider. Within Xero’s interface with Stripe and GoCardless, businesses can accept payments from clients online.

Xero was started in New Zealand in 2006 and today has over 2.7 million customers during the world. In New Zealand, Australia, and the United Kingdom, this accounting software is quite popular. Xero has around 3,500 workers and is quickly expanding in the United States.

Pros

- Payroll integration with Gusto

- Third-party app open market

- Simple accounting management

- Cloud-based

- Mobile app

Cons

- Restricted reporting

- Fees charged for ACH payments

Xero pricing

Xero provides three different monthly subscription plans as well as a payroll add-on.

Early: $11 per month

Growing: $32 per month

Established: $62 per month

Xero offers three monthly subscription options and a full-service payroll add-on: Early at $11 per month, Growing at $32 per month, and Established at $62 per month. Gusto provides a full-service payroll solution for an extra $39 per month + $6 per employee. The company provides a 30-day free trial as well as a two-month 50% discount promotion.

The Early plan restricts usage to five invoices or quotations, five bills, and the reconciliation of 20 bank transactions each month. This restricted plan may be appropriate for a micro-business that does a modest number of high-ticket transactions each month, such as a consultant or small service provider. Invoices, bills, and transactions are limitless in both the Growing and Established subscriptions. The sole difference is that the Established plan includes more capabilities like as multi-currency, spending management, and project costing. Hubdoc, a bill and receipt capturing tool, is included in all three levels.

03. FreshBooks

Invoicing is the most important accounting requirement for most service-based firms. In comparison to other accounting software, FreshBooks allows users more invoicing customization. Its major purpose is to send, receive, print, and pay invoices, but it may also do basic bookkeeping for a company. Service-based firms may use this accounting software to send proposals and invoices, seek deposits, collect client retainers, manage project time, and receive payments.

Pros

- Cloud-based

- User-friendly interface

- Third-party app integration

- Affordable

- Advanced invoicing features

Cons

- No inventory management

- No payroll service

- Mobile app has limitations

FreshBooks pricing

FreshBooks provide four plans:

Lite: $6 per month

Plus: $10 per month

Premium: $20 per month

FreshBooks launched as a simple invoicing software in Toronto in 2003. More features have been developed over time, and FreshBooks today employs over 500 people. There are four different options to select from, and corporations may save 10% by paying yearly rather than monthly. FreshBooks also provides a monthly discount of 60% for a period of six months.

The number of different clients who can be invoiced each month is the biggest variation between the four tiers. Up to five clients can be invoiced each month on the Lite plan. The Plus package allows you to bill up to 50 customers each month. Unlimited customers can be invoiced per month on the Premium plan. The Select plan similarly doesn’t have a restriction on how many clients may be invoiced every month, but it does have some unique features. The accounting software costs an extra $10 per month for numerous team members, and the advanced payment tool costs an extra $20 per month and allows users to charge a credit card in real-time or set up a recurring credit card charge for a customer.

Shopify, Gusto, Stripe, G Suite, and other third-party software connectors are also accessible. FreshBooks invoices may be fully personalised and adjusted for a professional appearance and feel, which is a unique feature. FreshBooks is a fantastic tool for planning tasks, delivering estimates and bids, and collecting money from customers.

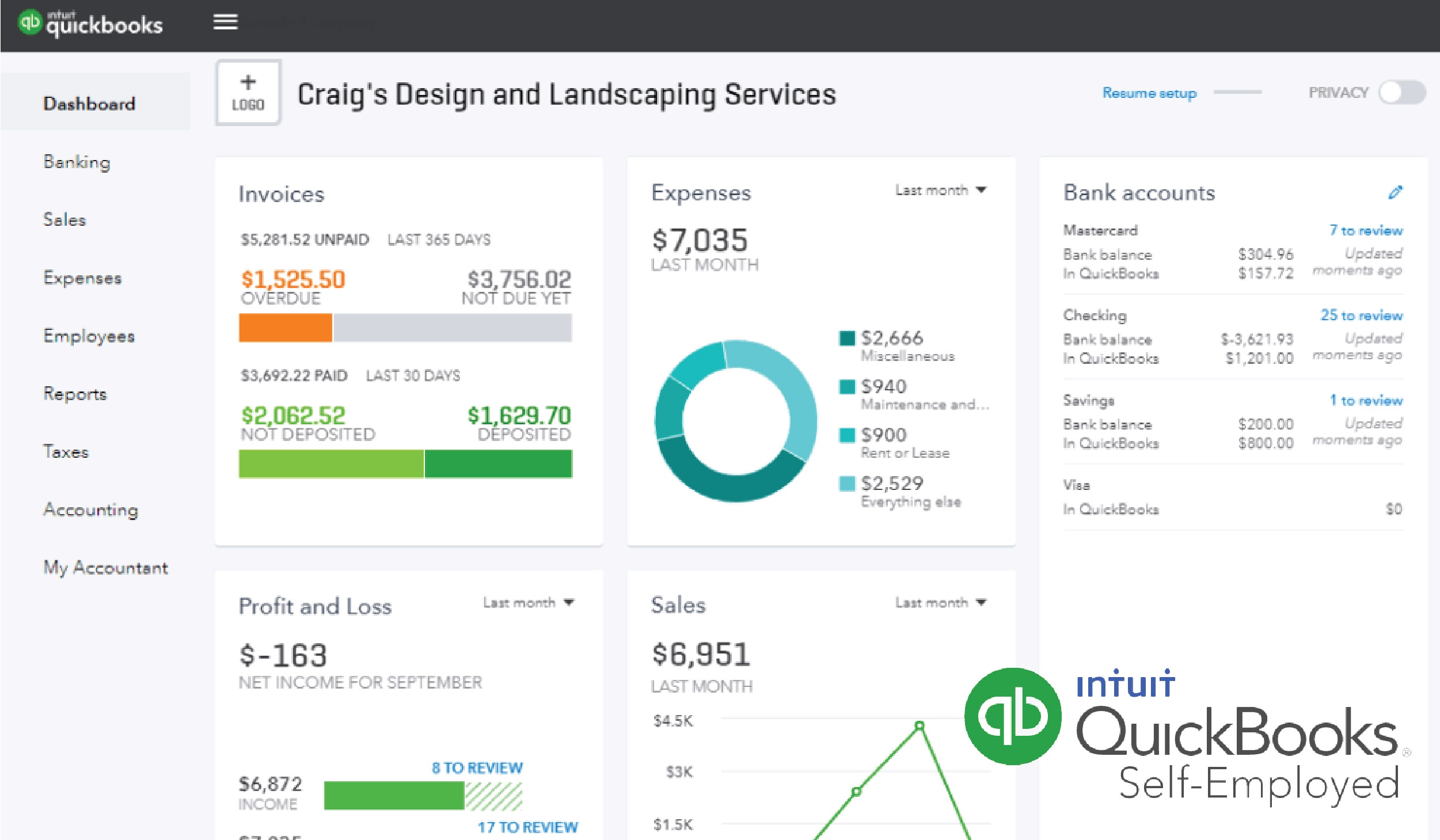

04. QuickBooks Self-Employed

For part-time freelancers and independent contractors who primarily want to manage their income and spending for their tax returns, we recommend QuickBooks Self-Employed accounting software. This software is for small company owners who file a Schedule C on their personal tax returns.

Without employing software like this to track company activities, freelancers would have to sift through all of their bank and credit card statements at the end of the year to tally up their revenue and spending, which can be time-consuming. All business transactions will be automatically totaled by QuickBooks Self-Employed.

Pros

- Cloud-based

- Mobile app

- Discriminate between business and personal expenses

- Synchronizes with TurboTax

Cons

- You may face data transferring problems with other accounting software

- It is limited reporting

- Limited invoicing customization

QuickBooks Self-Employed pricing

QuickBooks Self-Employed provides three plan options:

Self-Employed: $15 per month

Self-Employed Tax Bundle: $25 per month

Self-Employed Live Tax Bundle: $35 per month

For the first three months, there is a 50% discount. A TurboTax subscription for income tax filing is included in both tax bundles. The Self-Employed Live Tax Bundle also includes access to a CPA throughout the year and during tax season to answer inquiries. Before filing, the CPA will check your tax return in TurboTax one last time.

QuickBooks Self-Employed is an Intuit solution with a mobile app and a cloud-based internet interface. This software was intended to assist freelancers in staying organized throughout tax season each year. Tracking mileage, classifying spending, collecting receipts, issuing invoices, and calculating and filing taxes using TurboTax are all features of QuickBooks Self-Employed.

The mobile app makes it simple to track miles and take images of receipts for business costs while driving. Most accounting software does not distinguish between business and personal transactions, but QuickBooks Self-Employed has a function that allows you to label each transaction as either business or personal. This is advantageous for freelancers who do not have a separate bank account for their firm.

05. Wave

Wave is a great accounting platform for a service-based small business that doesn’t need to maintain inventory or conduct payroll. Wave’s free features will handle all of a freelancer’s or service-based company’ accounting needs, making it the top free software in our evaluation. Accountants may use Wave to pull the reports they need to compile a company’s tax return at the end of the year.

Pros

- Free invoicing, accounting, and receipt scanning

- No transaction or billing restricts

- You can maintain multiple businesses in one account

- There is no number of users

- Mobile app

Cons

- You can’t easily integrate with third-party app

- Credit cards and ACH payment fees are high.

- There is no inventory management

Wave is a Toronto-based company that was launched in 2010. H&R Block bought the firm in 2019 and now employs over 250 people. This free accounting software includes all of the basic accounting tools that most small businesses need. Such as income and cost management, financial reporting, invoicing, and receipt scanning. These functionalities are available both online and mobile application. Customer payment processing and payroll are regarded as premium services that incur additional fees, while all bookkeeping, invoicing, and reporting functions are available for free.

The payment gateway is where Wave makes its money. Wave charges processing payment from a customer, 2.9% plus 30¢ per transaction for Visa, Mastercard, and Discover, and 3.4% plus 30¢ per transaction for American Express. These costs are slightly greater than those associated with alternative accounting software. Wave also charges 1% for every transaction with a $1 minimum cost to handle an ACH payment rather than a credit card. Most of accounting software does not charge a fee for ACH payment processing, therefore this is unique to Wave.

As an add-on service, Wave provides two payroll options. The first plan is $20 per month + $6 per employee or contractor. Wave will handle payroll and calculate payroll taxes under this plan, but the user will be responsible for manually filling out payroll tax forms and sending tax payments. The second plan is $35 per month + $6 per employee or contractor. This package includes full-service payroll, which means that Wave handles all tax filings and payments. Only 14 states provide this full-service payroll solution.

vicki sippo